2021 contribution limits and deadlines

How can you hit the ground running in 2021 after maximizing all of your tax-advantaged accounts in 2020? Below you’ll find the most common retirement account types and health savings account contribution limits and the deadlines. Consider taking note of these limits in relation to your overall savings goals and building them into your cash flow sooner rather than later.

Traditional/Roth IRA contribution deadline

You can make a contribution all the way up until the tax return filing deadline of April 15, 2022 but naturally, it’s recommended that you open and fund these accounts well before such time to avoid any last minute headaches.

You can contribute to a traditional IRA regardless of income, but note that there are income limitations to make a deductible (pre-tax) contribution. For purposes of determining whether you can make a deductible contribution, modified adjusted gross income (MAGI) is defined as your adjusted gross income with the addbacks below. Consider using your prior year’s income/adjusted gross income (AGI) as a starting point if you don’t believe you’ll have a significant change in income.

IRA deduction

Student loan interest deduction

Tuition and fees deduction

Foreign earned income exclusion

Foreign housing exclusion or deduction

Exclusion of qualified savings bond interest shown on Form 8815

Exclusion of employer-provided adoption benefits shown on Form 8839

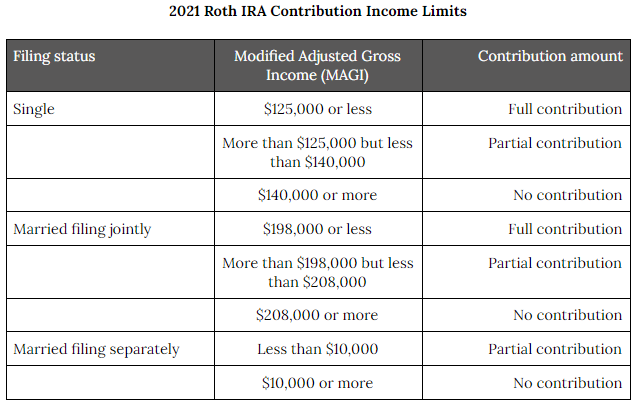

*While there are income limits to contribute directly to a Roth IRA, you can make what’s known as a backdoor Roth IRA contribution to bypass these limitations!

HSA contribution deadline

In order to be eligible to contribute to a health savings account (HSA), you must be covered by a high deductible health plan subject to the limitations listed in the table below. You are allowed to make contributions up until the tax filing deadline (April 15, 2022), but be sure to check with your plan sponsor as there might be plan-specific limitations.

Qualified plan contribution deadlines

The contribution deadline to qualified plans, encompassing most employer-sponsored plans (401(k)s, 403(b)s, profit-sharing plans, etc.), is the end of the calendar year (December 31, 2021).

In most cases, you’ve set this amount during your company’s open enrollment in the previous year. In nearly all cases, you’re able to change that amount at any time throughout the year. Some plans even allow you to write a check (as opposed to making contributions purely from your paycheck) to make a true-up contribution to get back on track, especially if you realize you aren’t contributing enough to obtain the maximum employer match or are on target to max out the annual contribution by the end of the year. If that option is not available to you, the sooner you can set the savings target that makes the most sense for your specific scenario, the easier it is to build that adjustment into your cash flow.

Small business/self-employed plan contribution deadlines

There are great retirement account options for those who own a small business, are self-employed or even have a consistent side income and want to contribute more towards retirement. The most appropriate plan will depend on a number of factors, including the size of the business, the amount of net income, and the overall goals of the owner. If you are at the point where it’s financially feasible to start setting savings aside, consult your tax professional to see which plan may make the most sense for your business type, ideally well before the end of the calendar year to give you enough time to prepare to set up the plan and make contributions.

Do you know how much you need to save in one or many of these accounts to meet your short and long-term financial goals? We can help, reach out to us now!